What is Insurance ?

When one pays a premium, one enters into a contract with the insurance company for protection against losses. The insurer agrees to provide coverage for losses such as illness, accidents, property damage, or liability claims described in the insurance policy based on the type of insurance purchased.

By shifting the liability of future losses from the insured to the insurer, insurance serves to reduce financial risk and offer peace of mind. Should a covered loss occur, the policyholder may submit a claim to the insurance provider, which will evaluate it and, if accepted, furnish benefits or compensation by the policy’s provisions.

An essential instrument for controlling risk, securing assets, and preventing unanticipated events that can cause loss or financial difficulty is insurance.

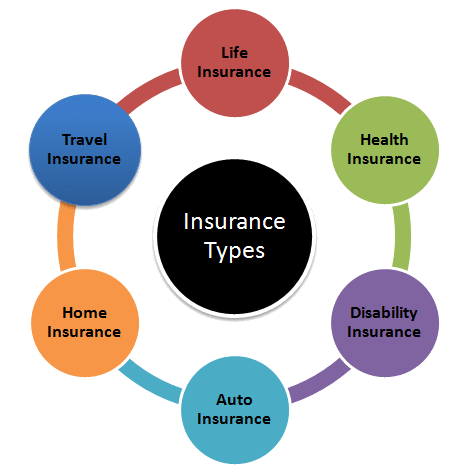

Types of Insurance Policies.

Life Insurance

It offers financial compensation to beneficiaries after the insured person has died. Various life insurance types are available, such as term life coverage, whole life, universal life, and variable life.

Health Insurance

Health insurance pays medical expenses for disease, injury, or illness. Coverage includes hospital stay and prescription drugs, surgery, and preventive care.

Auto Insurance

Provides financial protection to victims of losses arising out of physical damage or bodily injury caused by traffic collisions and also from vehicle accidents.

Homeowner’s Insurance

This insurance acts as a shield for the homeowners against property accidents i.e. damage to the house and its belongings. Generally, this insurance provides financial support in case of perils like theft, fire, and some natural calamities.

Renter’s Insurance

This insurance is similar to homeowner’s insurance. But this insurance is designed for renters. This insurance covers the personal property of the tenant at the tenant’s residence i.e. the tenant’s belongings or other belongings, as well as accidents occurring on the rented plot.

Property Insurance

Provides financial support to the victim and protects his businesses in case of physical damage or loss of buildings, equipment, and other assets. This insurance is mostly carried by businessmen. It also includes coverage for fire, theft, vandalism, and certain natural calamities.

Liability Insurance

Protects against claims for injuries to the suspect or damage to his property. This includes general liability Insurance for traders professional liability insurance (eg, malpractice insurance for healthcare professionals, etc.,) and product liability insurance.

Disability Insurance

This insurance provides financial protection to the holder if he is unable to work due to illness or injury. It may be temporary or lifelong. and may be offered through employer-sponsored plans. Or he can buy it personally. Disability Insurance More Details click Now..!

Travel Insurance

Travel insurance covers the loss of the victim to some extent in the event of travel cancellation, medical emergency loss of belongings, travel interruption, etc.

Cyber Insurance

Protects businesses against certain liability for losses from cyber attacks, data breaches, and other cybercriminal perils. This covers costs associated with data recovery, legal fees, and customer notifications. Cyber Insurance Purchase Details Click Now..!

Posts

- How To Become a Real Estate Digital Marketer (February 9, 2024)

- How to create a hosting server with Beginning Level (February 10, 2024)

- Strategies for Preventing Colds and Coughs (February 24, 2024)

- Insurance – What is Insurance ? Types of Insurance Policies. (February 29, 2024)

- Crypto FintechZoom Advantages Explained-FintechZoom? (March 7, 2024)

- Sri Lanka vs Bangladesh T20 series anyone (March 8, 2024)

- Phishing -What is Phishing?Definition, Phishing Examples (March 14, 2024)

- 7 Easy Steps to Create a Forum Website (March 16, 2024)